Can I Buy A Home if I Have Collections on My Credit Report?

Since buying a home is a big (and exciting!) investment, many people have questions surrounding the financial part of the process. Whether it’s, “Can...

4 min read

Twin Cities Habitat for Humanity

:

11:30 AM on July 6, 2023

Twin Cities Habitat for Humanity

:

11:30 AM on July 6, 2023

How far can one month's rent get you as a homeowner? If you've ever wondered whether you should keep renting or buy a home, you're not alone—many Minnesota residents are asking themselves the "buying vs. renting" question. Buying a home can have serious advantages: for some renters-turned-homeowners, rent money turns into additional square footage, an extra bedroom or bathroom, or even a backyard.

As it turns out, buying could be the better option for you. To find out for yourself, watch this video from our Homeowner Development team:

If any of those added home benefits sound appealing to you, check out these nine signs you may be ready to buy a house.

When renters buy a home, they typically take on a mortgage payment similar to their monthly rent payments. Covering a down payment tends to be one of the bigger challenges. Many mortgages require down payments between 10 and 20 percent of the purchase price of the home, though loans for eligible first-time buyers through the Federal Housing Administration (FHA) require 3.5 percent of the purchase price.

TCHFH Lending, Inc. offers TruePath Mortgage, a mortgage product that doesn’t require a down payment, only closing costs and some savings. Additionally, monthly mortgage payments are kept affordable at or below 30 percent of your income.

Checking your credit score should be one of your first steps when considering applying for a mortgage. This number tells lenders whether or not you’re reliable in making payments and managing current debt. Though a credit score of 580 is an acceptable score for some lenders’ mortgage products, a score of 620 or higher would likely get you an even better mortgage rate in the traditional mortgage market.

The preferred credit score for a mortgage with TCHFH Lending, Inc. is 620, but credit scores between 580-620 or invisible/no credit are acceptable with alternative credit documentation.

You'll need to show proof of steady employment to qualify for a mortgage. And while you won't be able to calculate closing costs, property taxes, utilities and other costs related to buying and living in a home just yet, you shouldn’t be spending more than you can afford on your housing payments. Things like vehicle loans, student loans, and credit card debt can add up. It’s important to keep these in mind as you consider taking on an additional loan. To qualify for a mortgage with TCHFH Lending, Inc., monthly debt payments must be no more than 13 percent of your gross monthly income.

Some financial advisers recommend setting aside a fund that can cover three months of expenses, but six months of savings would be even more ideal for those unexpected costs. This may also provide greater peace of mind, should an unforeseen event like a job layoff occur. You may also run into unexpected upkeep expenses, like fixing broken appliances. Having some savings will come in handy if and when those unpredictable home maintenance projects happen.

First-time homebuyers typically stay in their first home at least five to seven years. On average, Twin Cities Habitat homeowners stay in their homes for nearly 30 years. Plans change, of course, but to make the most of your decision, it makes the most financial sense to stay in a home for at least a few years.

Because rented spaces are managed by someone else, renters don’t always know how long they’ll be able to live in their rental home. Landlords and management can increase rent, ask you to leave, or kick you out at almost any time. This can make renters feel like they're at the will of others, while homeownership offers stability and security. When you own a home, you can be more sure of what your next month will look like, giving you more peace of mind and financial stability.

The TCHFH Lending, Inc. mortgage product payment is set for 30 years. You may see increases in homeowners’ insurance and property taxes, but what you pay toward principal and interest on your mortgage won’t change.

This is one of the major indicators that you’re ready to consider homeownership. Picturing yourself in a home with your family can help you see the future and motivate you toward achieving it. Even when renters aren’t sure about where to move, they can often pinpoint what they want in their buying vs. renting debate. What's at the top of their lists? Extra bathrooms and bedrooms, a larger kitchen, and a backyard.

.jpg?width=716&height=403&name=1600x900_2017%20Dedications%20-%20Site%201413%20+%201415%20-%2002.18.17%20-%20Paul%20D%20(76).jpg)

Oftentimes, new homeowners will find they have to temporarily give up some things they've become accustomed to or cut back on other expenditures for at least a few months. Eating out, going to the movies, getting takeout—some of your favorite ways to spend money might have to wait until you're settled into your new place.

When moving into a new home (especially a starter home), it's wise to prepare for new expenses, including cleaning supplies, tools, paint, window treatments, rugs, and more. It's safe to say you'll be making frequent trips to the hardware store (or ReStore)!

Paying rent doesn't build equity. All of your rent payments go to the property manager, so there's nothing to take or build when you make those payments.” Home equity is the difference between how much your house is worth today and the amount you owe. As a homeowner, every mortgage payment you make toward your home builds equity. Even your down payment is equity!

The internet has transformed the mortgage industry, as it has many other industries. But this transformation has also resulted in a deluge of information for consumers to wade through as they contemplate buying vs. renting.

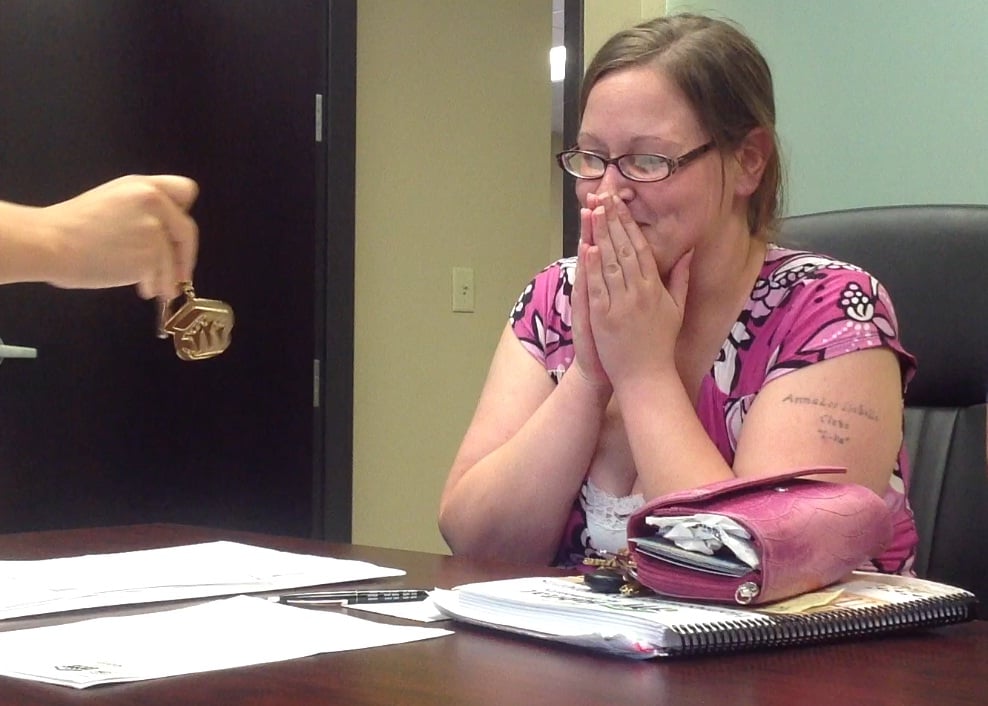

Instead of feeling overwhelmed, listen to the recommendations of people who have found the lending options and wise counsel they were looking for through the Twin Cities Habitat for Humanity Homeownership Program. Their positive, encouraging words could be the strongest sign of all on your buying vs. renting list.

Now is the perfect time to look into homeownership with Twin Cities Habitat. We provide you with the coaching, education, and support to be successful in your homebuying journey. Learn more about buying with Habitat!

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

Since buying a home is a big (and exciting!) investment, many people have questions surrounding the financial part of the process. Whether it’s, “Can...

Deciding what you want in your house is one of the most exciting things about shopping for your first home.

The path to homeownership can seem intimidating without a guide. Do you know you want to buy a home but aren't sure if you're ready? Perhaps you're...