Roots of Racial Wealth Inequities In Minnesota

Minnesota and the Twin Cities regularly rank highly on quality of life measures. However, both are also notable for the level of racial disparities...

3 min read

Guest Blogger

:

2:21 PM on November 10, 2021

Guest Blogger

:

2:21 PM on November 10, 2021

Guest Blog by Shoreé Ingram, Director of Equity and Inclusion

There is an old adage that says, “When America gets a cold, Black folks get the flu.” The national student debt crisis upholds that adage as true. Student debt negatively impacts so many low- to moderate-income people pursuing post-secondary education. But like any other social issue, Black folks face the heaviest of burdens. Research from Brookings reflects findings that Black college graduates carry more student debt than their White peers immediately after graduating. And that gap gets wider a few years after graduation. When we pair student debt disparities with income disparities, we find an alarming racial gap in the debt-to-income ratio. Debt-to-income, or DTI, is the percentage of your gross monthly income that goes toward paying your monthly debt payments. Lenders (including Twin Cities Habitat for Humanity) commonly measure a potential borrower’s debt-to-income ratio to determine the person’s financial stability and creditworthiness. If your DTI is too high, you may not get a loan or may get a loan with higher interest or unfavorable terms.

If lenders continue to rely heavily on DTI to assess potential borrowers, we are unlikely to make progress on our nation’s racial homeownership gap.

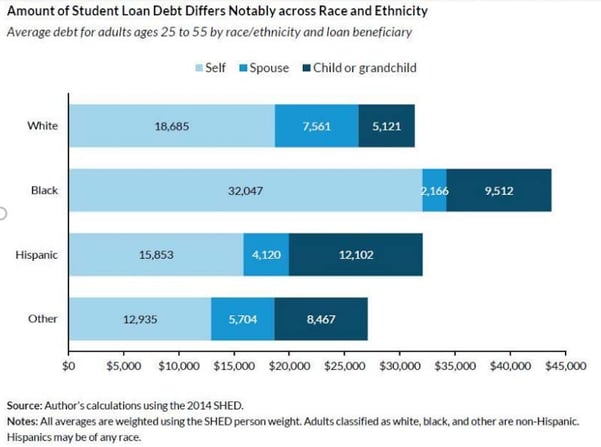

This issue of student loan debt compounds over time and generations. Data from the 2014 Survey of Household Economics and Decisionmaking (SHED) shows Black people are more likely to have education debt and more likely to borrow for their children and grandchildren (see figure 3). This suggests that parental wealth helps White people keep their debt borrowing lower – an indication of generational wealth and access, consistent with racial wealth gap research.

Now add on ‘the dream’ of homeownership. Those White graduates who had parental help with paying for college now have less debt as they begin to think about buying a home. Meanwhile, their Black peers are in deeper debt and are likely to earn less income with the same level of education.

Education costs are on the rise for everyone. But Black people pursuing homeownership to build wealth are facing an uphill battle, especially in the Twin Cities and throughout Minnesota. On top of rising education costs, Black people face widening gaps in income and wealth, racialized lending factors like credit scores and debt-to-income ratios, and ongoing racial discrimination in employment, wages, and housing practices. Achieving homeownership is near impossible for Black Americans—even those with moderate incomes.

What can we do? I am glad you asked! Consider the following ways we can creatively find solutions to alleviate the debt-to-income barrier caused by student loan debt for everyone, especially Black homebuyers.

Student loan debt is clearly linked to homeownership and generational wealth building. Those disparities are linked, and they compound one another. The adage "when America gets a cold, Black folks get the flu" is as true today as it ever was when you look at our country's vast racial disparities. But because all racial disparities are linked, if you can improve one disparity it will impact the others. Solutions exist. We just need to be bold enough to put the solutions into action.

One simple thing you can do right now is to equip yourself with knowledge. Racial disparities are well documented across so many aspects of life. Read on to learn more about racial gaps in:

And you can learn more about race and housing in our Race & Housing Resource Center. You'll learn more about the history of racist housing policies right here in the Twin Cities, and get more ideas for action.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

Minnesota and the Twin Cities regularly rank highly on quality of life measures. However, both are also notable for the level of racial disparities...

From the outside, buying a home can sometimes look easier than it is. In theory, it’s straightforward enough – provide the needed documents, follow...

Black families in Minnesota face unique challenges when trying to buy a home. For generations, these barriers were overtly racist housing policies...