Report: Prepare for new wave of mortgage foreclosure

At the end of February, the annual ‘Foreclosures in Minnesota’ report was published, and the trends we are seeing are promising, but indicate we...

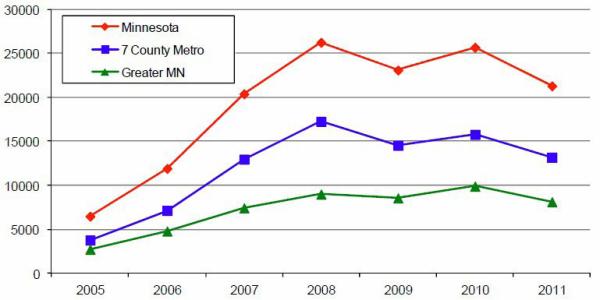

Five years ago, foreclosures in Minnesota were at an all-time high. Thankfully, with recent changes in legislation, much of the foreclosure activity has been quelled.

The foreclosure crisis may be slowly fizzling out, but there remain homeowners for whom the threat of losing everything is alive and terrifying. If you count yourself among them, there are a number of questions you can ask to determine the level of risk you may be facing:

If you answered yes to any of these, you may be at risk of foreclosure. Thankfully, there is still hope. Twin Cities Habitat for Humanity’s Mortgage Foreclosure Prevention Program (MFPP) helps homeowners at risk of or in mortgage foreclosure; if this is you, please don’t hesitate to contact us at (612) 305-7163 or click here to learn more about Twin Cities Habitat’s MFPP.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

At the end of February, the annual ‘Foreclosures in Minnesota’ report was published, and the trends we are seeing are promising, but indicate we...

Foreclosure has affected many people across the country during the last five years; but one group is becoming more and more in need of foreclosure...

While we as housing counselors try to find the best solution for all of the homeowners who visit our organizations, sometimes foreclosure is...