Do I Have to Make a Down Payment to Get My First Home Loan?

While looking to buy your first home is a very exciting chapter in your life, for some, it can be difficult to look past the down payment. In fact,...

2 min read

Twin Cities Habitat for Humanity

:

8:39 AM on May 16, 2018

Twin Cities Habitat for Humanity

:

8:39 AM on May 16, 2018

Choosing the right down payment amount has a big role to play in buying a house. Especially for first-time homebuyers, understanding the value of a down payment — and how it saves you money in the long run — may make it easier for you to save up.

Choosing the right down payment amount has a big role to play in buying a house. Especially for first-time homebuyers, understanding the value of a down payment — and how it saves you money in the long run — may make it easier for you to save up.

Making a larger down payment means that you will have smaller mortgage payments each month. These monthly savings add up over the life the loan but require having more money available at the time of purchase.

A down payment is a lump sum of money that goes directly to the person selling the house. Your mortgage lender will pay the seller the rest of the purchase price.

The amount of money you borrow from the lender is your mortgage. You will make monthly mortgage payments to the lender for the length of the loan, usually 15 or 30 years.

The down payment goes directly to the seller and immediately establishes your equity, which is the difference between the value of the home and how much you owe for any mortgages on the property.

This provides protections to the lender by reducing the risk that your mortgage will ever be more than the value of the property.

Most people need to save to come up with a down payment, but it’s worth making the effort. Here are some ways to save:

Note: You may want to borrow money for your down payment by taking out a property loan, but that extra debt will make you a less appealing buyer in the seller’s mind.

A down payment calculator will help you decide how much to put down by considering the location and the price range of the house.

The calculator will use your financial information to identify different mortgage types available. The results will estimate for you:

If you can afford it, there are benefits to making a down payment of 20% or more of the purchase price of the house.

Those include:

Private mortgage insurance (PMI) is required for down payments of less than 20%. The smaller your down payment, the higher your PMI will be.

PMI, which is added to the monthly mortgage payment for the life of the loan, will impact the amount you can afford to borrow.

Many homeowners chose to pay PMI rather than wait until they can make a larger down payment.

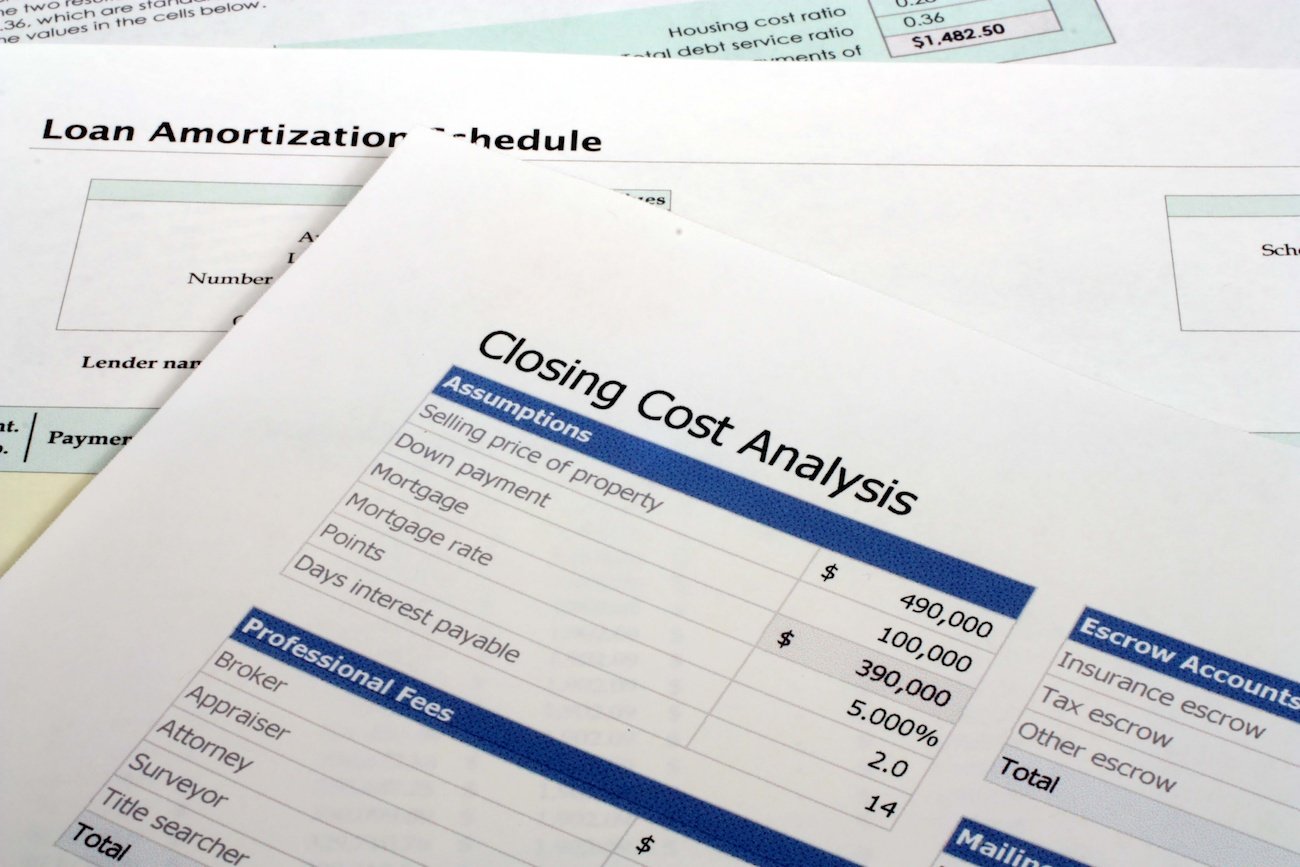

If your down payment is under 20%, the lender may charge closing fees. And closing fees are usually higher the smaller the down payment is. Sometimes, lenders charge a higher interest rate instead of closing fees.

Remember, only a small percentage of homebuyers can make a large down payment. And there are many options for homebuyers who can make small down payments.

Check with your county or city housing authority for more information on current programs that you may qualify for.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

While looking to buy your first home is a very exciting chapter in your life, for some, it can be difficult to look past the down payment. In fact,...

Even if you haven't paid them, chances are you've heard of "closing costs" associated with buying a home. But what are mortgage closing costs? What...

Buying a home comes with many different expenses to consider.