What Am I Paying For? A Breakdown of Mortgage Closing Costs

Even if you haven't paid them, chances are you've heard of "closing costs" associated with buying a home. But what are mortgage closing costs? What...

2 min read

Twin Cities Habitat for Humanity

:

3:35 PM on September 3, 2019

Twin Cities Habitat for Humanity

:

3:35 PM on September 3, 2019

![3 Important Documents You'll Sign When Closing on a House [VIDEO]](https://www.tchabitat.org/hubfs/3%20Important%20Documents%20Youll%20Sign%20When%20Closing%20on%20a%20House%20%5BVIDEO%5D.png)

Congrats, you found your first house! We know you're excited to move in and make  it your own, but before you start hauling boxes, there are a couple steps you have to take to make the deal official.

it your own, but before you start hauling boxes, there are a couple steps you have to take to make the deal official.

With any big purchase, there’s going to be some paperwork. It's easy to skim through the pile of mortgage closing documents and sign away, but it's important to understand what you're agreeing to.

Here’s a simplified breakdown of what documents you're signing when completing the closing disclosure form, the note, and the mortgage itself, brought to you by Jen LaCroix, Community Loan Officer for TCHFH Lending, Inc.:

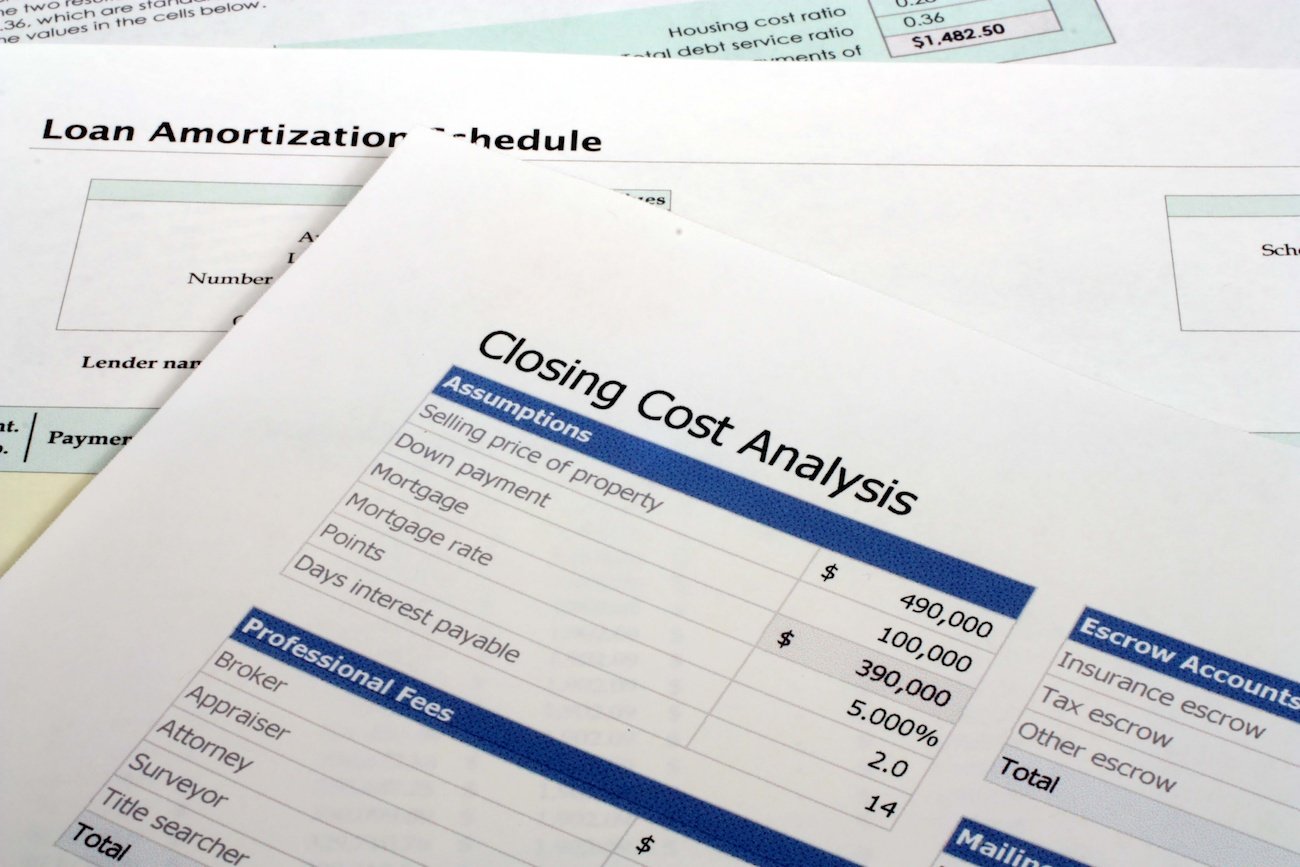

The closing disclosure form should be delivered to you at least three days before your closing date. It provides details about your mortgage including the interest rate, term, and your projected monthly payment. It also breaks down your closing costs.

"You're going to see all the final numbers before closing," says Jen. "That's an important document, and you'll want to keep your eyes out for that before closing."

Read through the closing disclosure form and compare it to the loan estimate you received from your lender after you completed your mortgage application. It's common to see some differences among the numbers, but the terms of your loan should be the same. If you have any questions about your loan, ask your lender.

"At closing, once there, you'll be signing the note and the mortgage," explains Jen. The note is often called a promissory note (also known as a written promise). It represents your commitment to pay back the money you're borrowing to purchase the home.

It explains everything you need to know about your mortgage including the loan amount, the length of the loan, the interest rate, payment due dates, grace period for late payments, late charges, and other details of the agreement. Check that these numbers are exactly what you're expecting, so that you’re comfortable with what you’re promising. Share any concerns or mistakes you notice. You'll want them changed before you sign.

The mortgage secures the note. This allows the lender the legal right to take your home away in the event that you don’t honor the promise to pay what you signed in your note. This process is known as foreclosure.

Simply put by Jen, "The mortgage is the agreement and it also outlines the terms of the note and paying the note back."

Your mortgage will involve two parties:

When it comes to closing on a home, anyone borrowing money to pay for a house will sign these three mortgage closing documents listed above. There will be a lot of additional documents to sign along the way, but those vary depending on each homebuyer's individual situation and lender. Be prepared to ask about each document you sign to ensure you are comfortable with what you are agreeing to.

If you're unclear about the mortgage closing documents above or have additional questions throughout your journey of becoming a first time home buyer, we encourage you to contact our team of experts today.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

Even if you haven't paid them, chances are you've heard of "closing costs" associated with buying a home. But what are mortgage closing costs? What...

Now that we've moved on to 2019, we wanted to look back on what made 2018 a truly unique and whirlwind year. So, buckle up—let's go for a ride...

![9 Things to Do Before Closing on a House [VIDEO]](https://www.tchabitat.org/hubfs/2023%20Blog%20Images/September%202023%20Blog%20Images/closing-on-home.jpg)

Closing on your first home can feel overwhelming, but it doesn't have to be. Whether you're working with a traditional lender or exploring programs...