Fixed- vs. Adjustable-Rate Mortgages: What’s the Difference? [VIDEO]

This blog mentions an out-of-date interest rate. For current information on Twin Cities Habitat mortgage interest rates, please visit our TruePath...

1 min read

Twin Cities Habitat for Humanity

:

11:55 AM on July 19, 2019

Twin Cities Habitat for Humanity

:

11:55 AM on July 19, 2019

![Budgeting Your Monthly Cost of Owning a Home [VIDEO]](https://www.tchabitat.org/hubfs/Screen%20Shot%202019-07-17%20at%201.31.07%20PM.png)

As a first time homebuyer, it’s important to understand all the costs that go into owning a home. For starters, did you know that your monthly house payment actually includes more than just the principal and interest of your mortgage?

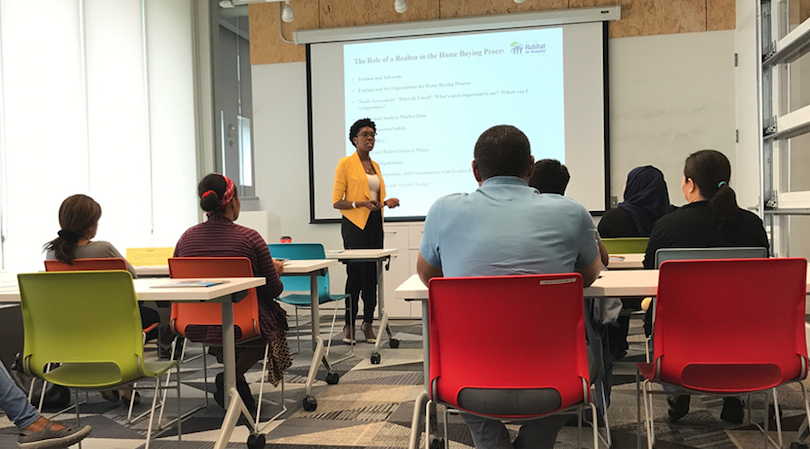

William Bolton, Homeownership Advisor with the Twin Cities Habitat for Humanity’s Homeownership Program, breaks down the various monthly costs of homeownership and how to budget for them:

“A mortgage payment wraps up four different types of payments that you make when you make your regular monthly mortgage payment,” says William.

The easy way to remember these payments is “PITI,” (Principal, Interest, Taxes, Insurance). So, make sure you can afford your PITI before buying a house!

A general rule of thumb for budgeting is that 50% of your income should be spent on your needs (like your PITI, utilities, grocery bill, etc.), 30% can be used on your wants, and 20% is reserved for your savings.

“When I’m looking at a budget, I’m usually trying to fit my clients into that rule to make sure they’re prepared for homeownership and something unexpected doesn’t throw them completely off their budget,” said William, who plans monthly budgets for families in the Homeownership Program.

With the Homeownership Program at Habitat for Humanity, we build and rehab homes for our clients, or our clients can work with a real estate agent to find a home within their budget on the open market. Our mortgage product helps keep the monthly payments affordable

Interested in the program and how it can help you find a home inside your budget? Visit our Homeownership page to learn more.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

![Fixed- vs. Adjustable-Rate Mortgages: What’s the Difference? [VIDEO]](https://www.tchabitat.org/hubfs/Screen%20Shot%202019-07-24%20at%208.32.11%20AM.png)

This blog mentions an out-of-date interest rate. For current information on Twin Cities Habitat mortgage interest rates, please visit our TruePath...

The biggest consideration when making any large purchase decision is how you’re going to budget for it. And for most people, buying a home is the...

Everybody knows that no two people are exactly the same. That’s why Twin Cities Habitat for Humanity offers multiple pathways for potential...