10 Things You Might Not Know about Twin Cities Habitat for Humanity

Almost everyone has heard of Habitat for Humanity—which is great! But sometimes we discover that there can be misconceptions about what we do, how we...

3 min read

Twin Cities Habitat for Humanity

:

8:30 AM on February 1, 2019

Twin Cities Habitat for Humanity

:

8:30 AM on February 1, 2019

January 1, 2025

January 1, 2025

When you think of Twin Cities Habitat for Humanity’s Homeownership Program, you might imagine a family buying a volunteer-built home for an affordable price. But there’s a whole lot more!

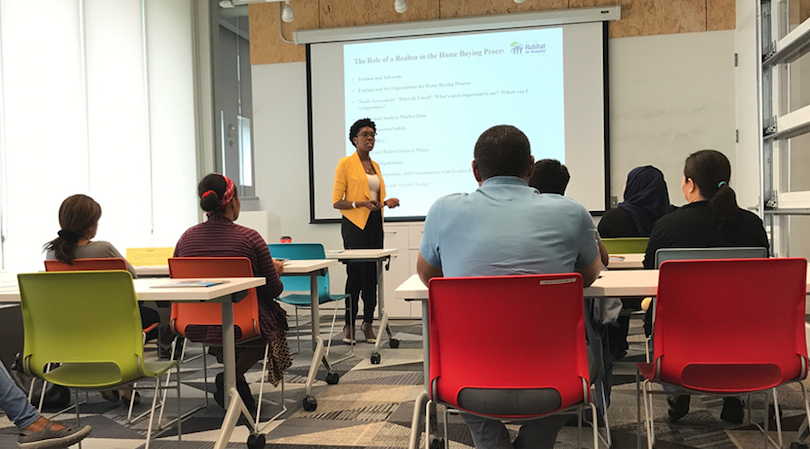

We created an innovative mortgage program for first-time homebuyers. Qualified households can buy a home on the open real estate market using affordable mortgage financing from TCHFH Lending, Inc., our nonprofit mortgage subsidiary. Through this new open market mortgage option, we actively partner with REALTORS® to give homebuyers more purchasing power to find a home they love anywhere in the Twin Cities seven-county metro area.

If you're an agent working with a first-time homebuyer, here's what you need to know about Twin Cities Habitat for Humanity's Homeownership Program. After you learn about our program and mortgage product, check out the Habitat Realtor Network and sign up to attend an upcoming Realtor Connect meeting.

As a REALTOR®, you know what first-time homebuyers are looking for and what they need to succeed in this hot market. Habitat provides it all:

Habitat staff are here to help clients all along the way. Our Homeownership Advisors work with clients from introduction and program application, through education and mortgage readiness. The mortgage team ensures each homebuyer has the best financing package to help them affordably buy a home they love. All homeowners are set up for success with monthly mortgage payments that are no more than 30% of their household income.

For buyers who aren’t yet working with an agent, our homebuying process educates them on how to work with a REALTOR®.

See all mortgage details here.

*For example, on a $240,000 30-year fixed rate loan at an annual interest rate of 5.50% with no down payment, your monthly payment would be $1,362.69 and the APR would be 5.5577%. The monthly payment amount does not include sums for homeowner’s insurance premiums or property taxes, all of which must be paid in addition to the principal and interest on your mortgage loan.

Potential homeowners must first complete our Homeownership Program. Here is the general criteria for our Homeownership Program. If you are working with a homebuyer right now, your client can get started here today.

Now, you have one more tool in your toolbox to help first-time homebuyers fulfill their dream of owning a home.

Learn about the benefits of joining the Habitat Realtor Network today. You’ll have the opportunity to gain access to insider knowledge, affordability assistance for your clients, and more. And, once you close homebuyer loans with us, we provide additional benefits to recognize your partnership. We look forward to working with you to help your clients buy a home they love with a mortgage they can afford.

REALTOR® is a federally registered collective membership mark which identifies a real estate professional who is member of the NATIONAL ASSOCIATION OF REALTORS® and subscribes to its strict Code of Ethics.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

Almost everyone has heard of Habitat for Humanity—which is great! But sometimes we discover that there can be misconceptions about what we do, how we...

The biggest consideration when making any large purchase decision is how you’re going to budget for it. And for most people, buying a home is the...

Twin Cities Habitat for Humanity is three months into a pilot program designed to advance Black homeownership across the Twin Cities seven-county...