What Realtors® Should Know About Habitat for Humanity's Homeownership Program

January 1, 2025 When you think of Twin Cities Habitat for Humanity’s Homeownership Program, you might imagine a family buying a volunteer-built home...

6 min read

Twin Cities Habitat for Humanity

:

2:20 PM on July 10, 2024

Twin Cities Habitat for Humanity

:

2:20 PM on July 10, 2024

Almost everyone has heard of Habitat for Humanity—which is great! But sometimes we discover that there can be misconceptions about what we do, how we work, and who buys homes with Twin Cities Habitat for Humanity. We've created this list to help everyone understand what, exactly, Twin Cities Habitat is all about.

Click below or keep scrolling to learn more about Twin Cities Habitat!Households partner with Twin Cities Habitat to buy a home they love with a mortgage they can afford. Our TruePath Mortgage(1) is available to households who may otherwise be unable to obtain conventional mortgage financing. All buyers must meet our financial requirements—which include (but are not limited to) minimum income, savings, and debt-to-income ratio.

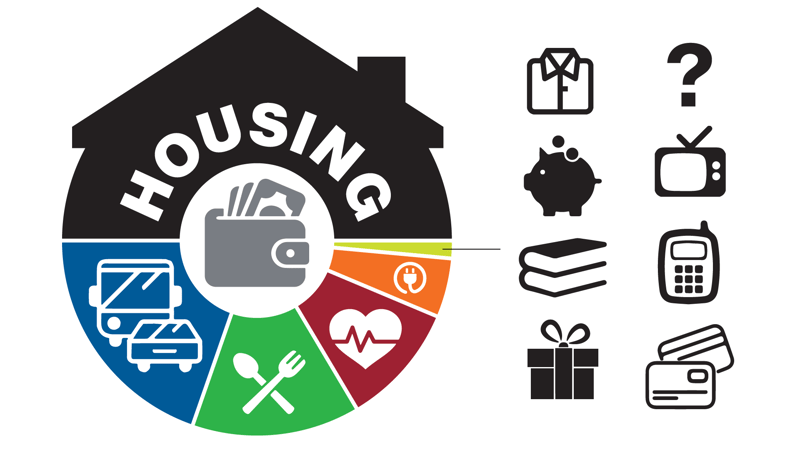

Every family pays an affordable mortgage, originated by our nonprofit mortgage subsidiary, TCHFH Lending, Inc. Monthly mortgage payments are set at no more than 30% of homebuyers’ monthly income. The 30% cap ensures that families can afford all the necessities of life—including decent healthcare, nutritious food, transportation, and education.

Homeowners are responsible for their monthly mortgage payment, which includes the principal and interest, property tax, and homeowner's insurance escrow.

.webp?width=731&height=487&name=PD-2-22-2018-11%20(1).webp)

Households who partner with Twin Cities Habitat have a variety of options for purchasing a home. After they qualify for our Homeownership Program, they have the option to buy a home built or rehabbed by Twin Cities Habitat, or they can work with a realtor to find a home they love that’s for sale on the open market.

No matter which path they take, all Habitat homebuyers must meet Habitat's program and mortgage underwriting criteria, complete our homeownership education classes, and apply for a mortgage through our wholly-owned mortgage company, TCHFH Lending, Inc.

Research shows conclusively that affordable housing has no negative impact on home prices. In 2023, the A-Mark Foundation published a review of nine studies on the impact of affordable housing on property values. A surprising finding was found by seven of the studies—when affordable housing was built, the property values in those neighborhoods actually increased.

In Minnesota, Twin Cities Habitat homes also tend to have a positive effect on neighborhoods. For example, several Twin Cities Habitat homes were built in the Hawthorne EcoVillage in North Minneapolis during the 2008 housing crisis. A five-year report on that neighborhood shows Habitat’s work coincided with significant decreases in foreclosures, vacant properties, and drug arrests. The report also shows an increase in owner-occupied homes and the number of new trees planted.

Twin Cities Habitat develops quality, attractive, and practical modern homes. All homes built or rehabbed by Habitat meet or surpass every building code in the communities where we build. On top of that, we aim to match the size and quality of surrounding homes. You could drive through a few townhome developments throughout the metro and have no way of knowing which were Habitat townhomes and which were market-rate.

All homes must pass stringent inspections by city or county inspectors. While most work is done by volunteers, all volunteers are trained and supervised by Habitat staff. In addition, plumbing, electrical, roofing, and other skilled work is done by licensed professionals.

Twin Cities Habitat builds every one of its new construction homes to meet LEED certification standards and is the #1 builder of ENERGY STAR rated homes in Minnesota. We install active radon mitigation and continuous vent systems and use low VOC paints. This means that Habitat homes are both more cost-efficient for homeowners and better for our planet.

Twin Cities Habitat for Humanity is an Equal Opportunity Lender and a Fair Housing organization. We follow all Equal Opportunity Lending and Fair Housing laws, and we do not discriminate based on race, religion, nation of origin, gender, sexual orientation, family status, marital status, or any other protected classes.

Our staff is prepared to work with households at various levels of preparedness for homeownership. We encourage anyone who meets our eligibility criteria to find out if buying with Habitat might be right for you. Even if you might not be ready for Habitat's homeownership program, we can refer you to another organization in our referral partner network to help guide you to mortgage-readiness, some of which have specific demographic or community focuses.

It’s simple math: the more that housing costs take from your income, the less you have to invest elsewhere. For folks who need to spend more than a third of their income on housing, things like healthcare, nutritious food, education, transportation, saving for the future, and investing in the local economy get harder to afford. When you have a home that’s affordable for you, all those other areas of your community benefit as well.

Additionally, more often than not affordable housing enhances local tax revenues by improving substandard housing stock. Instead of low or no payment of taxes by distressed properties, homeowners and renters who live in affordable housing contribute to the community. For example, Twin Cities Habitat homeowners contribute millions in property taxes each year to the metro area.

Whether you rent or own, if your housing is affordable, you can stop moving as frequently and put roots down in your community. And that’s a win for everyone.

There is not one state in the United States where a full-time minimum wage worker can afford to rent a two-bedroom apartment. The average minimum wage worker would have to work almost 100 hours per week (or 2.4 full-time jobs) to afford a one-bedroom apartment. When 40%, 50%, or even more of your money is spent on housing, there isn’t enough left over to pay for adequate healthcare, decent nutrition, or the educational needs of children.

Habitat homeowners are much better off financially than those who rent. With Habitat mortgages* structured to cap monthly payments at 30% of household income, Habitat homeowners can pay their monthly housing bills and still have money left over for other necessities and savings.

When homeownership rates increase, it lifts up the entire community. Habitat homebuyers tend to be active in their communities, and they’ve reported that their kids’ academic performance improves after becoming homeowners (read the full study from Wilder Research). That positive impact multiplies for generations.

Local Habitat for Humanity affiliates are independent, nonprofit organizations that operate within specific service areas and abide by the framework of the Habitat Affiliate Covenant. Each affiliate focuses its building, repair, mortgage lending, and fundraising efforts within their service area. Habitat for Humanity International shares branding, marketing, and research with local affiliates to help us achieve our goals, but it exercises no direct authority over local affiliate programming.

We’re grateful to be part of a network of 1,300+ Habitat affiliates worldwide and are proud to participate in Habitat’s global mission through our Global Engagement work. We’re also proud to be a leader among Habitat affiliates—we were recognized by Habitat for Humanity International as an Affiliate of Distinction, one of just five affiliates of our size to receive the honor.

Both Habitat for Humanity International and Twin Cities Habitat for Humanity are independent, nonprofit organizations and are not part of the government.

We do accept some government funds, grants, and property to advance our mission. To access these funds, we must meet certain criteria and be good stewards of those resources.

Habitat for Humanity was started in 1976 in Americus, Georgia by the late Millard Fuller and his wife, Linda. The idea for the ‘fund for humanity’ was based on Reverend Clarence Jordan’s work at Koinonia Farm. He wrote, “What the poor need is not charity but capital, not case workers but co-workers.” It’s this basic philosophy of ‘co-working’ that continues to guide our work today.

But what about former President Jimmy Carter? You’ve probably heard about his affiliation with Habitat for Humanity, but let’s be clear: Jimmy Carter is not the founder of Habitat.

However, President Carter and his wife, Rosalynn, were longtime supporters and dedicated volunteers. Their home in Plains, Georgia was eight miles from Americus and they connected to Habitat’s mission in 1984.

From 1984 to 2019, they led the Jimmy and Rosalynn Carter Work Project to help build houses and raise awareness of the need for affordable housing. In October of 2010, the Carter Work Project spent a week in Minneapolis and St. Paul building and repairing homes. We're proud to be hosting the 2024 Carter Work Project at The Heights in St. Paul, where country stars Trisha Yearwood and Garth Brooks will be continuing the Carters' legacy.

Below are some great sources for information about poverty and housing issues:

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

January 1, 2025 When you think of Twin Cities Habitat for Humanity’s Homeownership Program, you might imagine a family buying a volunteer-built home...

-3.jpg)

This blog has been updated to include information about a recent Twin Cities Habitat event. On Thursday, October 7, Twin Cities Habitat hosted the ...

![Home is [still] out of reach for many Minnesotans](https://www.tchabitat.org/hubfs/blog/2019%20Blog%20Images/October/1%20in%20four%20housholds.png)

Maybe you've heard about the affordable housing crisis. Do you know the data behind it? A few months ago, Minnesota Housing Partnership (MHP)...