Why Winter Might Be the Best Time to Buy a House in MN

Bare trees, fallen snow, and cold temperatures don't usually make people think of house hunting, but maybe they should! While spring and summer...

2 min read

Twin Cities Habitat for Humanity

:

9:00 AM on May 29, 2018

Twin Cities Habitat for Humanity

:

9:00 AM on May 29, 2018

Owning a home comes with a lot of benefits. You can customize your home any way you like, find comfort in knowing you'll live in the same place for several years, invest in something that is truly yours, have more privacy than you did when renting, and even earn tax benefits.

Owning a home comes with a lot of benefits. You can customize your home any way you like, find comfort in knowing you'll live in the same place for several years, invest in something that is truly yours, have more privacy than you did when renting, and even earn tax benefits.

You're likely familiar with most of those benefits already, but you may have questions about the tax benefits. To help you save as much money as possible, here are five homeowner tax benefits to take advantage of.

Each year, all the interest you paid toward your mortgage can be deducted from your taxes.

Your mortgage lender will issue you a form, called 1098, that will tell you how much interest you’ve paid throughout the year.

If you prepaid interest fees to your mortgage lender, you likely saved some mortgage points. A point costs 1% of your mortgage amount. Mortgage points can be used to lower your interest rates on your mortgage and save you money on taxes.

To claim mortgage points as a deduction, enter the prepaid fee amount as a deduction on your tax return and label the fee with the points you earned.

Another big deduction you can claim is property taxes. These are taxes you paid based on the value of your property, which includes your home and the land.

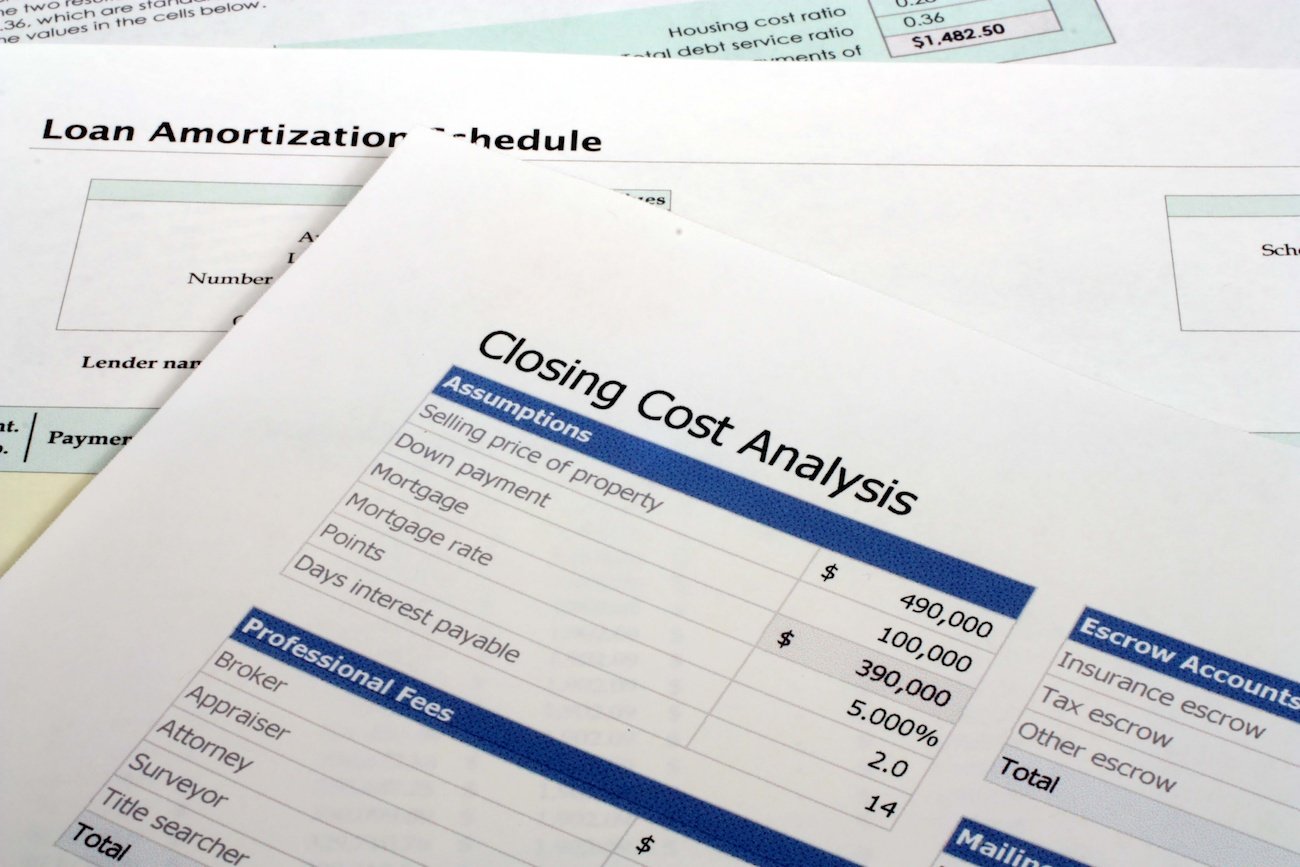

If your mortgage lender pays your property taxes with money you paid into an escrow account, that amount will be listed on your 1098 form. If you paid your property taxes directly, save the receipt for your records. And if you prepaid any property taxes at closing, you'll find that amount on your Settlement Statement. This is a document your mortgage lender gave you that shows services and fees that were charged to you as part of the closing.

Note: Under the new tax legislation that passed in late 2017, state and local taxes including real estate taxes are limited to $10,000 for people who itemize deductions.

If you’ve just bought a new home, you probably won’t be thinking about this tax benefit just yet. But when the time comes to sell your home, know that the money you make by selling your home might not be taxable.

If you have lived in your home two out of the last five years, the first $250,000 of profit (or $500,000 if you and your spouse file taxes jointly) is exempt from capital gains taxes.

Some home improvements may also lower your tax obligation when you sell your home. Improvements that actually add to significant value to the home can be deducted from the profits of your sale, so save your receipts. Eligible expenses include finishing-off a basement, adding an extra room, or replacing a roof (which adds long-term usefulness).

Be aware that normal repairs and home maintenance are not tax-deductible, and your profits may already fall under the $250,000/$500,000 exclusion mentioned above.

If you still have questions regarding homeowner tax benefits, you should speak with a tax accountant for more help!

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

Bare trees, fallen snow, and cold temperatures don't usually make people think of house hunting, but maybe they should! While spring and summer...

Congratulations, you’re a homeowner! You paid your down payment, signed on the dotted lines, and are now holding the keys to your very own home. But...

Even if you haven't paid them, chances are you've heard of "closing costs" associated with buying a home. But what are mortgage closing costs? What...