7 Things to Avoid Between Loan Pre-Approval and Your Home Closing

You're pre-approved for a home loan—congratulations! You're about to embark on one of the most exciting parts of your homeownership journey, and...

2 min read

Twin Cities Habitat for Humanity

:

9:39 AM on January 22, 2018

Twin Cities Habitat for Humanity

:

9:39 AM on January 22, 2018

Buying a house is a big deal, especially when it comes to financing it. What is your credit score? What does your debt-to-income ratio look like? Do you have enough money saved for additional costs?

Buying a house is a big deal, especially when it comes to financing it. What is your credit score? What does your debt-to-income ratio look like? Do you have enough money saved for additional costs?

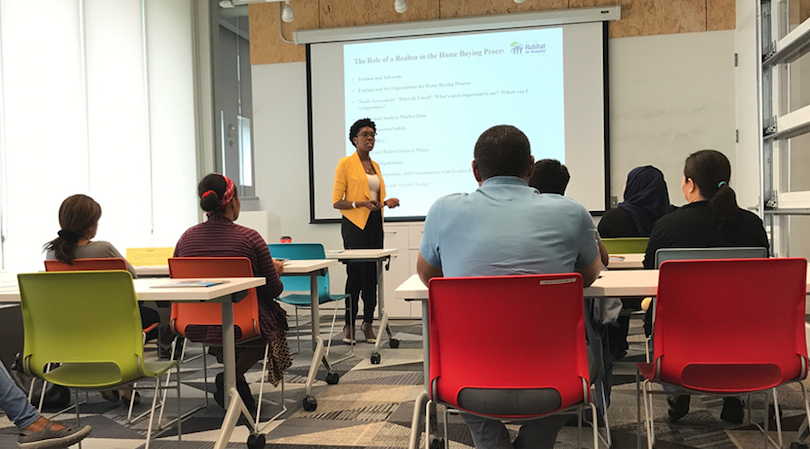

We know there is a lot to juggle when buying your first home, and you may have more questions than answers right now. We're here to help. Our Homeownership Program provides financial coaching to best prepare you for the expenses ahead. Here are some our most frequently asked questions.

Our financial coaching program is designed to get you mortgage ready in one year or less. Your Financial Empowerment Coach will help you develop a plan towards mortgage readiness and help keep you on track with that goal.

One of Habitat for Humanity's financial coaches will meet one-on-one with you to review the Habitat Homeownership process, paths to becoming a homeowner, your income, and how close you are to mortgage readiness.

The goal is a credit score of 620 or above to move into the home-buying process successfully. If you're not already there, we'll help you get there!

Your debt-to-income ratio is your monthly debt payments divided by your gross monthly income. We require you have a ratio of 18% or lower when you begin financial coaching. That number should be between 13% and 15% when you're done with the program. It is possible for it to be lower than 13%, but it cannot be more than 15% in order to qualify as mortgage ready.

Homebuyers must have $6,300 in savings to be considered Mortgage Ready — $3,000 is for closing costs, $1,500 will cover the first year of homeowner's insurance, and $1,800 is a common amount to hold onto in case of emergencies.

| Before Financial Coaching | After Financial Coaching | |

| Debt-to-Income Ratio | 18% or lower | 13% – 15% |

| Closing Costs | -- | $3,000 |

| Homeowners Insurance | -- | $1,500 |

| Emergency Fund | -- | $1,800 |

If your numbers do not match what is considered to be mortgage ready, your coach will work with you to develop a plan to move you toward mortgage readiness.

Our goal is to prepare you for success in your home buying experience. All of these steps – including our one-on-one conversations regarding credit score, debt-to-income ratio, and savings – help to lay the groundwork for purchasing your first home.

Financial coaching focuses on preparing people to buy and finance a home. Our Homebuyer Education Training is focused on topics like home repair, public safety, neighborhood and community, and other things that will help you be a successful homeowner.

If you have any other questions, feel free to visit the Twin Cities Habitat for Humanity Homeownership Program page or call us at 612-540-5660. We're always happy to help.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

You're pre-approved for a home loan—congratulations! You're about to embark on one of the most exciting parts of your homeownership journey, and...

Online real estate listings are full of attractive photos and virtual video tours of homes for sale, but the best way to get the feel for a house is...

While looking to buy your first home is a very exciting chapter in your life, for some, it can be difficult to look past the down payment. In fact,...