Women leaders address the concerning link between health and housing

In the same week a report was released naming the Twin Cities one of the most expensive cities for medical costs, a group of leaders from the metro...

1 min read

Jared Laabs

:

3:16 PM on November 15, 2017

Jared Laabs

:

3:16 PM on November 15, 2017

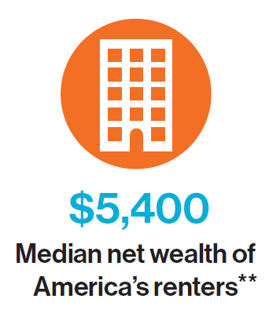

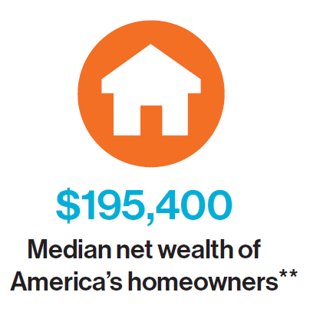

One out of four homebuyers that partner with Twin Cities Habitat for Humanity are single women raising children, and nearly all Habitat homebuyers families include mothers and children. It’s data points like these that fuel the fight for affordable housing with groups like Women of Habitat. Raising over $135,000 during the 2017 annual luncheon this past October, the annual Hope Builders Luncheon brings women together to fundraise, but also puts the spotlight on issues and facts that cannot be ignored. The statistics below demonstrate the wide disparity between renters and homeowners.

Source: Federal Reserve Bulletin

Source: Harvard Study

During this year's luncheon, a panel of experts passionately discussed how affordable housing can help a family create a pathway toward financial independence. The foundation of a stable home paired with affordable mortgages allows families to dedicate resources for health and education that can help provide good nutrition, health care, transportation, education or even savings for the future.

Each family in the homeownership program completes coaching and homeownership training. They receive customized one-on-one financial coaching to talk through their finances and work on any areas that may need improvement, such as credit scores, budgeting, growing savings and/or reducing debt. Not only do Habitat homebuyers learn what’s required to be a successful homeowner, but they also have access to a post-purchase support team that can provide things like home maintenance advice, resources to make community connections, and additional financial guidance, if needed.

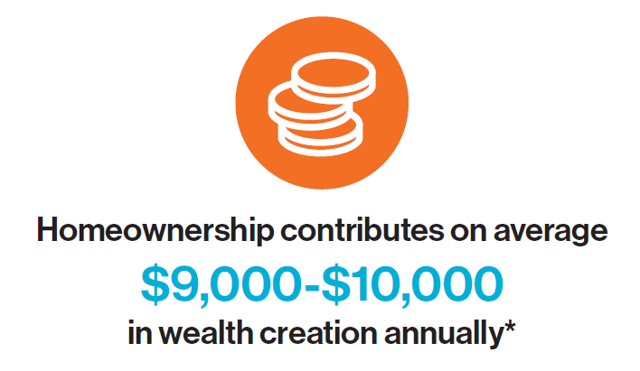

SOURCE: Harvard study

It’s not hard to imagine how impactful the transition to homeownership can be for families, and it's an important milestone that we celebrate with home dedications. Homeownership contributes on average $9,000 to $10,000 in wealth creation annually. This is great news for families, but it gets better. A 2015 Wilder study shows that 41% visit the doctor less frequently. 68% say their kids' grades improve and more than twice as many families report no longer needing public assistance

after buying their Habitat home. Habitat homeowners’ reduced reliance on public

assistance saves Minnesota taxpayers $6.4M to $9.3M each year. Not only do families health and finances improve, but the impact reaches generations, the community, and beyond.

Learn how you can change a family’s life and make a difference in our community. Twin Cities Habitat has several programs and volunteer opportunities big and small.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

In the same week a report was released naming the Twin Cities one of the most expensive cities for medical costs, a group of leaders from the metro...

In the days leading up to Mother’s Day, crews of women volunteers will be scraping, priming and painting the home of Sheila Nash; raising both...

Twin Cities Habitat is proud to announce that Bremer Bank has committed to be the primary partner in its new Home Loan Impact Fund. Bremer has agreed...