Deadline Approaching: Unique Tax Credit and Chance to Support Habitat

While this might seem too good to be true, it's not! Thanks to the newly created State Housing Tax Credit (SHTC) and Contribution Fund, you can...

3 min read

Twin Cities Habitat for Humanity

:

12:23 PM on December 12, 2025

Twin Cities Habitat for Humanity

:

12:23 PM on December 12, 2025

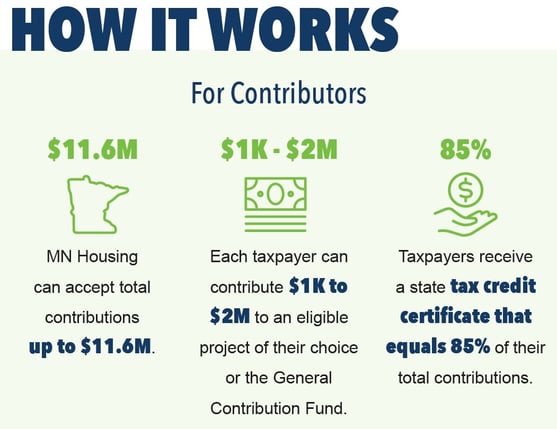

Thanks to the State Housing Tax Credit (SHTC) Program and Contribution Fund, you can support housing development projects across Minnesota and get a tax credit equal to 85% of your contribution. It's a simple process that only takes a few minutes.

This is an extremely popular program, so we encourage you to get your application in quickly once the opportunity opens. Minnesota Housing will begin accepting applications to contribute to the State Housing Tax Credit (SHTC) Contribution Fund starting Monday, February 17, 2026.

The Minnesota Legislature created the State Housing Tax Credit (SHTC) Program and Contribution Fund as a new way to help finance affordable multifamily and single-family housing throughout the state. SHTC is entirely funded with eligible Minnesota taxpayer contributions. Contributions to the fund will provide funding for loans for eligible housing projects in communities throughout the state.

Individuals and businesses who pay state taxes and meet eligibility requirements can contribute anywhere from $1,000 to $2 million. The Fund provides a tax credit of 85% of the contribution. For example, a $1,000 contribution would amount to $850 in tax credit. Or, if you contribute $10,000, you'll get $8,500 in tax credit. This is not a tax deduction, but a credit that offsets your state taxes.

“The state tax credit program is one of the most amazing pieces of legislation we’ve seen in a long time,” says Chris Coleman, president and CEO of Twin Cities Habitat for Humanity. “It’s an incredibly simple way to help your tax burden while investing in much-needed affordable housing in Minnesota.”

You can designate your contribution to support qualifying projects developed by nonprofits like Twin Cities Habitat for Humanity. This year Twin Cities Habitat for Humanity is championing two developments as Qualified Projects for the State Housing Tax Credit (SHTC) and Contribution Fund. Click the links below for additional information about these opportunities and how supporters can designate contributions to support Twin Cities Habitat.

With your designated tax contribution, Twin Cities Habitat will build 10 new units of affordable homeownership in the Minnetonka Mills neighborhood, two of which will be accessible homes. This is the first major Habitat project coming to Minnetonka in over 20 years, and your support brings much needed affordable housing options to this community.

With construction starting in 2025 and running through 2028, the twinhomes will be built on underutilized property from Minnetonka Mills Church. Many partners are coming together to make these historic homes a reality. All that’s needed is you!

Twin Cities Habitat is in the process of building the Towering Woods Townhomes in Prior Lake, bringing 12 units of affordable homeownership to this southwest suburb. Eight of the units have been completed, and site work for the final four homes is currently under construction.

Affordable housing is badly needed in Scott County, but securing funding has proven difficult. Twin Cities Habitat has built fewer than five homes in Prior Lake in our 40-year history. A generous donation got this townhome project off the ground, and now we need help from donors like you to finish.

Donor names from STHC fund contributions are not shared with project developers, so if you decide to complete an application to support the Mills Twinhomes or the Towering Woods Townhomes, please share with Twin Cities Habitat so we may recognize your allocation.

The SHTC funds are available on a first-come, first-served basis until utilized each year. Last year, the funds were used up by March 2025, so it’s important to make your contribution early in the year.

To participate, prospective contributors must fill out a very simple online application through Minnesota Housing— it only takes 5 minutes! Each taxpayer can contribute $1K to $2 million to an eligible project of their choice or to the general contribution fund.

While individuals and companies can designate their contribution either to a general pool or to any of 48 housing development projects, we hope you'll consider contributing to Twin Cities Habitat for Humanity’s projects.

See for yourself how easy and simple the process is! Check out these example applications:

We hope contributors will view this tax credit opportunity as a unique way to contribute Mills Twinhomes and Towering Woods Townhomes, in addition to philanthropic donations that support the breadth of our work across the seven-county metro. We recommend you consult with your tax preparer or financial advisor on deciding if this program is right for you.

More details and information can be found from MN Housing: https://www.mnhousing.gov/shtc-contribution.html

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

While this might seem too good to be true, it's not! Thanks to the newly created State Housing Tax Credit (SHTC) and Contribution Fund, you can...

Minnesota must get its housing in order. Years of steady cost increases and stagnant wage growth have broken home economics across the state. Today’s...

If there was a Housing Hero spotlight beacon (think Bat-Signal) that we could turn on above the State Capitol in St. Paul we’d be doing it right now....