Reflections on my time as Habitat's Advocacy Intern

We continue to process the pain and hope of our nation’s uprising for racial justice amid a global health crisis. You can see ourrecent statements...

4 min read

Julia Hobart

:

4:10 PM on June 18, 2020

Julia Hobart

:

4:10 PM on June 18, 2020

We continue to process the pain and hope of our nation’s uprising for racial justice amid a global health crisis. You can see our recent statements on the uprising here, our COVID-19 web page here, and our Race & Housing resource center here. Expanding homeownership is a key component of racial equity and health, so our mission has never been more important—and we’ll continue to share the stories of Habitat’s work.

Twin Cities Habitat for Humanity supports Cost of Home, a national campaign to expand housing affordability for ten million people in the next five years. The Cost of Home campaign has four essential policy priorities:

Today, we’ll look at the third priority. Take a peek at our recent blogs on supply and preservation and land use, and keep an eye out for our final blog about developing communities of opportunity.

Credit is one of the most common indicators of financial reliability. With a good credit score, you can qualify for that apartment you wanted, buy your first home, or start a business. If your score is low, it can prevent you from accomplishing your goals. Of course, one way to improve credit is by making consistent, reliable payments against borrowed money. However, poor credit can make it hard to get a loan in the first place. Simply put, credit can make or break your financial wellbeing.

LeAndra holding the keys to the home she bought with Twin Cities Habitat in 2019.

In 2017, the Urban Institute published research showing that the median credit score for white neighborhoods in Minneapolis was 728, whereas the median credit score for non-white neighborhoods was 570 – a gap of 158 points. Nationally, the gap between white and non-white areas was nearly 80 points. Why do these disparities exist today? And how did credit become so inequitable?

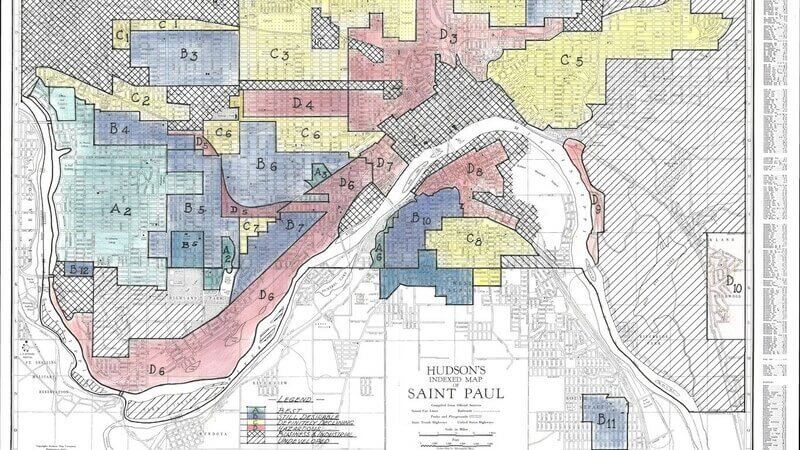

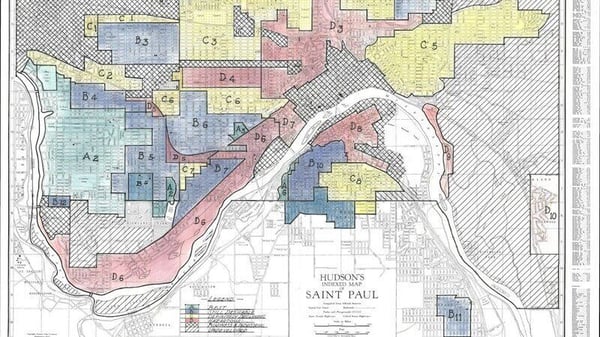

The answer lies in decades of discriminatory policymaking and lending. In the 1940s and ‘50s, the Federal Housing Administration (FHA) deliberately shut Black Americans out of New Deal reforms. Government practices such as redlining incentivized state and local lending agencies to deny credit to families of color and religious minorities. And private lenders and homeowners used racial covenants to prevent minorities from homeownership. Check out our blog series, Race and Housing, to learn more.

These racist policies and practices led to what can be described as a “dual credit market.” People who benefited from New Deal policies—namely white Americans—bought homes, developed credit, and built wealth. Eventually, they passed these assets on to their children, who continued to benefit from the equity their parents had achieved. People who were excluded from New Deal policies—mainly Black Americans and other minorities—were denied access to wealth-building tools such as loans, credit, or homeownership, and therefore had fewer assets to give to their children. Today, the average Black household has just 9% of the wealth of the average white household.

A map showing redlining in St. Paul, which denied Black neighborhoods opportunities to build wealth and credit.

Within the dual credit market, financial institutions continue to deny wealth to people of color. Dr. Samuel Myers, Jr., a professor at the University of Minnesota, studied the lending practices of the Twin Cities’ 50 largest banks from 2008 to 2013. He found that banks discriminated against racial minorities in “non-trivial” and “statistically significant” ways, based on criteria other than credit risk or income.

On the other hand, certain lenders deliberately target people of color and low-wealth individuals. So-called “payday lenders” offer short-term, easily attainable loans, often for $500 or less. These loans come with exorbitant fees, which can be devastating to low-income borrowers. Consumers who are tight on cash and unable to repay the loan on time can quickly rack up interest and fees totaling more than the loan principle. When this happens, borrowers can get trapped in a cycle of debt that depletes their earnings and damages their credit score.

Without a solid credit score, many buyers will be denied loans or home mortgages. Because of the fraught history of housing policy and lending practices in the United States, we see stark racial inequities today – both in homeownership rates and credit scores. One way to counteract these disparities is to make secure credit opportunities accessible to low-income borrowers and borrowers of color. Habitat for Humanity International has several policy recommendations for equitably increasing access to credit.

First, we can work to strengthen housing finance systems. Legislation like the Community Reinvestment Act creates an incentive for lenders to invest in their communities. Banks who prioritize investment in low-income neighborhoods receive preference from federal regulators. Unfortunately, recent federal changes have curbed the effectiveness of this program. But advocates can continue to push for policy that creates housing finance options for low- and moderate-income communities.

Next, we can advocate for updated credit scoring and underwriting standards. Lenders like TCHFH Lending, Inc., our mortgage subsidiary, offer more flexible underwriting requirements than traditional lenders. Policies and funding that allow nonprofits to be more flexible with mortgage criteria ensure that credit—and homeownership—can be a possibility for first-time homebuyers.

We can promote fair lending and consumer protections. Advocates can work to combat predatory lending practices, improve fairness and non-discrimination in lending criteria, and expand loan alternatives for those who may not have the credit to qualify.

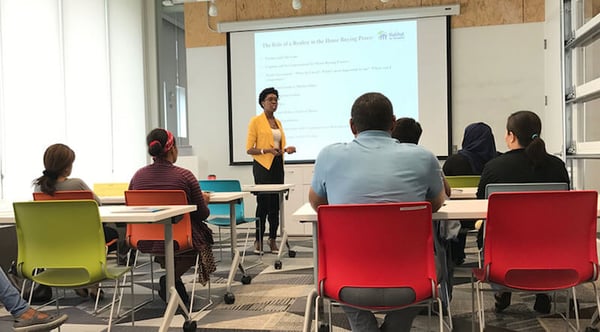

Finally, we can expand asset development and housing counseling. Policies that support programs like Twin Cities Habitat’s financial coaching program can help borrowers navigate financial hurdles and develop their assets over time. Other strategies include downpayment assistance, mortgage subsidy programs, and homebuyer tax incentives. By advocating for these multiple and intersecting solutions, we can increase equitable access to credit and work to repair the damage done to communities of color.

Habitat clients participate in homeownership education classes and one-on-one homeownership advising sessions.

Interested in advocating with Twin Cities Habitat? Sign up to get our Action Alerts!

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

We continue to process the pain and hope of our nation’s uprising for racial justice amid a global health crisis. You can see ourrecent statements...

We continue to process the pain and hope of our nation’s uprising for racial justice amid a global health crisis. You can see ourrecent statements...

.png)

We continue to process the pain and hope of our nation’s uprising for racial justice amid a global health crisis. You can see ourrecent statements...